Do Land Trusts Pay Property Taxes . Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a. Web in fact, the irs does not even consider a land trust to be a trust at all. Web some people are concerned that their property taxes will go up if their real property is placed in a trust. You should also consider the tax and legal implications of setting up a land trust. Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid.

from sites.utexas.edu

Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web some people are concerned that their property taxes will go up if their real property is placed in a trust. You should also consider the tax and legal implications of setting up a land trust. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid. Web in fact, the irs does not even consider a land trust to be a trust at all. Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a.

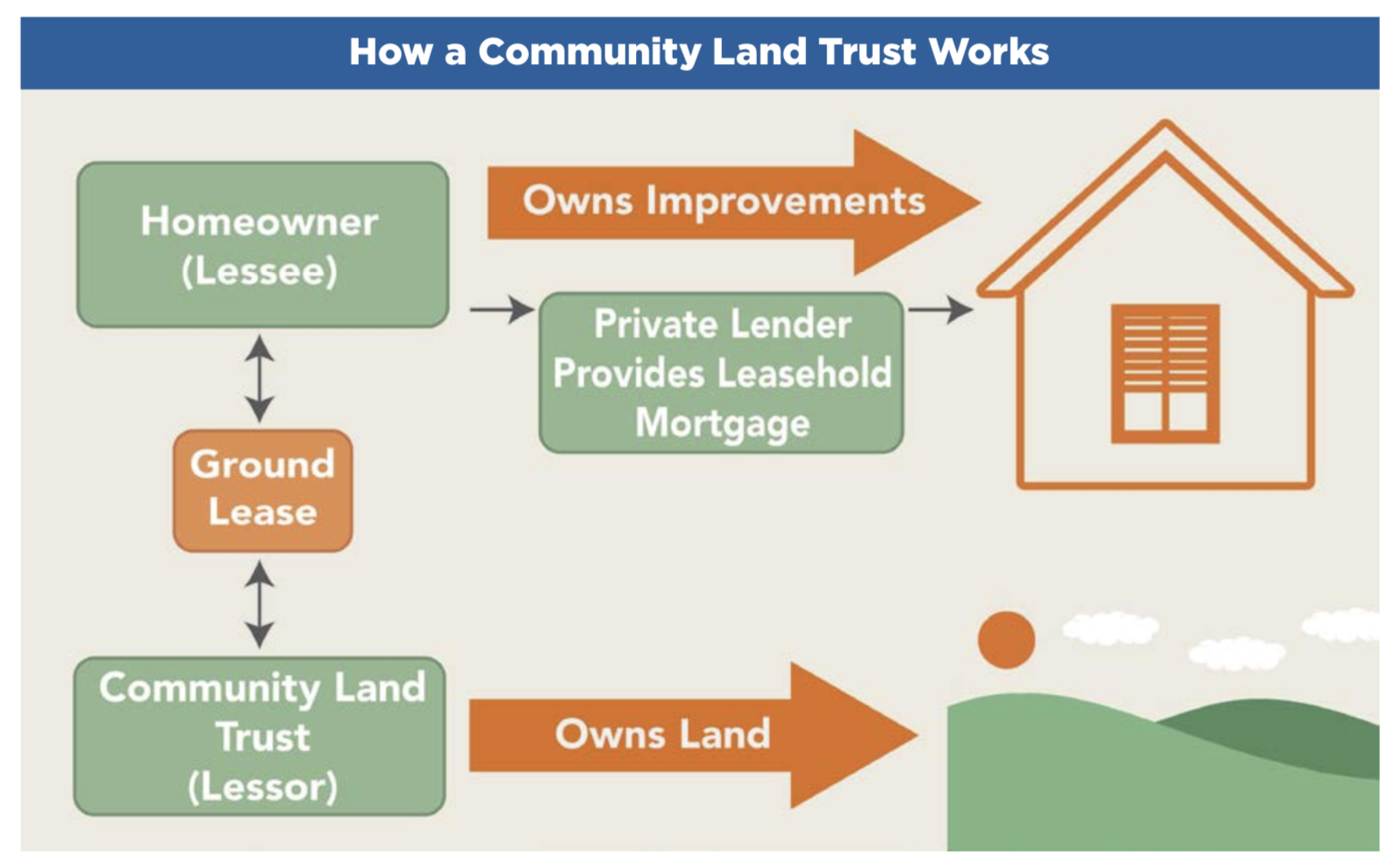

Community Land Trusts (CLTs)

Do Land Trusts Pay Property Taxes Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web some people are concerned that their property taxes will go up if their real property is placed in a trust. Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid. Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a. You should also consider the tax and legal implications of setting up a land trust. Web in fact, the irs does not even consider a land trust to be a trust at all.

From cityofbridgesclt.org

The Community Land Trust Model City of Bridges Do Land Trusts Pay Property Taxes Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a. You should also consider the tax. Do Land Trusts Pay Property Taxes.

From www.youtube.com

Should You Use A Land Trust Or LLC To Purchase Real Estate? YouTube Do Land Trusts Pay Property Taxes Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid. You should also consider the tax and legal implications of setting up a land trust. Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a. Web in fact, the irs. Do Land Trusts Pay Property Taxes.

From www.financestrategists.com

Land Trust Definition, Importance, and Types Do Land Trusts Pay Property Taxes Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web some people are concerned that their property taxes will go up if their real property is placed in a trust. You should also consider the. Do Land Trusts Pay Property Taxes.

From studylib.net

The Use of Land Trusts and Business Trusts in Real Estate Do Land Trusts Pay Property Taxes Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web some people are concerned that their property taxes will go up if their real property is placed in a trust. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance,. Do Land Trusts Pay Property Taxes.

From miska.co.in

All you wanted to know about property tax Do Land Trusts Pay Property Taxes Web in fact, the irs does not even consider a land trust to be a trust at all. Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web along with estate tax benefits, there are. Do Land Trusts Pay Property Taxes.

From www.youtube.com

Do Land Trusts Protect Your Real Estate Assets? (Transfer REAL ESTATE Do Land Trusts Pay Property Taxes Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web in fact, the irs does. Do Land Trusts Pay Property Taxes.

From www.youtube.com

Why You Should Consider Land Trusts YouTube Do Land Trusts Pay Property Taxes Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid. You should also consider the tax. Do Land Trusts Pay Property Taxes.

From www.printablerealestateforms.com

Printable Land Trust Agreement Sample Form (PDF & WORD) Do Land Trusts Pay Property Taxes Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. You should also consider the tax. Do Land Trusts Pay Property Taxes.

From morrisinvest.com

EP298 What's the Deal with Land Trusts? Morris Invest Do Land Trusts Pay Property Taxes Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web a land trust for estate. Do Land Trusts Pay Property Taxes.

From www.hippo.com

Your Guide to Property Taxes Hippo Do Land Trusts Pay Property Taxes Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web some people are concerned that their property taxes will go up if their real property is placed in a trust. You should also consider the. Do Land Trusts Pay Property Taxes.

From www.dochub.com

Land trust template Fill out & sign online DocHub Do Land Trusts Pay Property Taxes Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid. Web in fact, the irs does. Do Land Trusts Pay Property Taxes.

From www.cashflowdepot.com

Introduction to Land Trusts for Real Estate Investors by Jack Miller Do Land Trusts Pay Property Taxes Web in fact, the irs does not even consider a land trust to be a trust at all. Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web some people are concerned that their property. Do Land Trusts Pay Property Taxes.

From www.icsl.edu.gr

Do You Pay Property Taxes On A Mobile Home Do Land Trusts Pay Property Taxes Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid. Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a.. Do Land Trusts Pay Property Taxes.

From www.thehivelaw.com

Tax Implications Of Transferring Property Into A Trust The Hive Law Do Land Trusts Pay Property Taxes Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid. Web in fact, the irs does not even consider a land trust to be a trust at all. Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a. Web when. Do Land Trusts Pay Property Taxes.

From www.pewtrusts.org

Change in Philadelphia Land Tax Value Raises Taxes for Many Properties Do Land Trusts Pay Property Taxes Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a. Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web in fact, the irs does not even consider a land trust to be a trust at all. Web a. Do Land Trusts Pay Property Taxes.

From farmlandaccess.org

Trusts Farmland Access Legal Toolkit Do Land Trusts Pay Property Taxes Web along with estate tax benefits, there are income tax benefits that a landowner can experience by donating to a. Web when property is held in a trust, the trustee ensures payment of property taxes, but whether your being a. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid.. Do Land Trusts Pay Property Taxes.

From www.pinterest.com

Do Community Land Trusts Work? A series on Trust 1 Street smart Do Land Trusts Pay Property Taxes Web some people are concerned that their property taxes will go up if their real property is placed in a trust. Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web a land trust for. Do Land Trusts Pay Property Taxes.

From www.slideserve.com

PPT Special Needs Trusts Tax Issues PowerPoint Presentation, free Do Land Trusts Pay Property Taxes Web before setting up a land trust, you should consult with an attorney or other trusted advisors to determine if a land trust is the right choice for you and your real estate assets. Web a land trust for estate planning is when a trustee holds property title for heirs to simplify inheritance, avoid. Web along with estate tax benefits,. Do Land Trusts Pay Property Taxes.